A while ago, I wrote a post on how Digg is characterized by the principles of Game Theory. As it turns out, that post was Dugg to the front page of Digg and almost fried my server. Today, I want to briefly discuss something along the same lines of Behavioral Economics — how Twitter solves the problem of Information Asymetry.

In Decision Theory, Information Asymetry deals with situations where one or more parties has more or better information than the other. In the case of Voter decisions, Twitter, the fascinating microblogging platform, is a simple solution to a nasty problem of Information Asymetry.

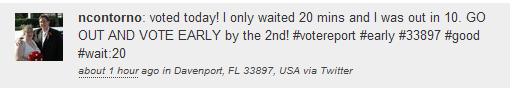

A really simple example is having to deal with the decision of where and what time to vote: this decision involves one’s personal schedule but also the conditions of the voting area — are the machines working? super long lines? weather? — twitter, in this case, becomes an uncomplicated solution to a historically and, theoretically, tough problem. Specifically, Twitter Vote Report was created to aid the exact problem I just described.

Even more broadly, imagine if more Stock Traders were on Twitter: most likely, Stock Traders would have been sending Tweets about the massive sell-off in the market last week several minutes before CNN could publish the news — the difference in minutes or seconds can be huge. The problem of “Information Stickiness” or Information Asymetry is becoming less and less of a problem because of Twitter.

Something interesting:

Check out the segment below on Congressional Tweeting – tweets sent out by senators and congressman during a senatorial or congressional session.

Conversely, Twitter also increases information assymetry. Using the stock market as an example, information assymetry can be increased by having more outsiders twittering than insiders twittering (insiders being those in the know, while outsiders are those who think they are in the know).